Insights

Popular Articles

Latest Articles

The easy way to pay

Orikan, solutions for a smarter future.

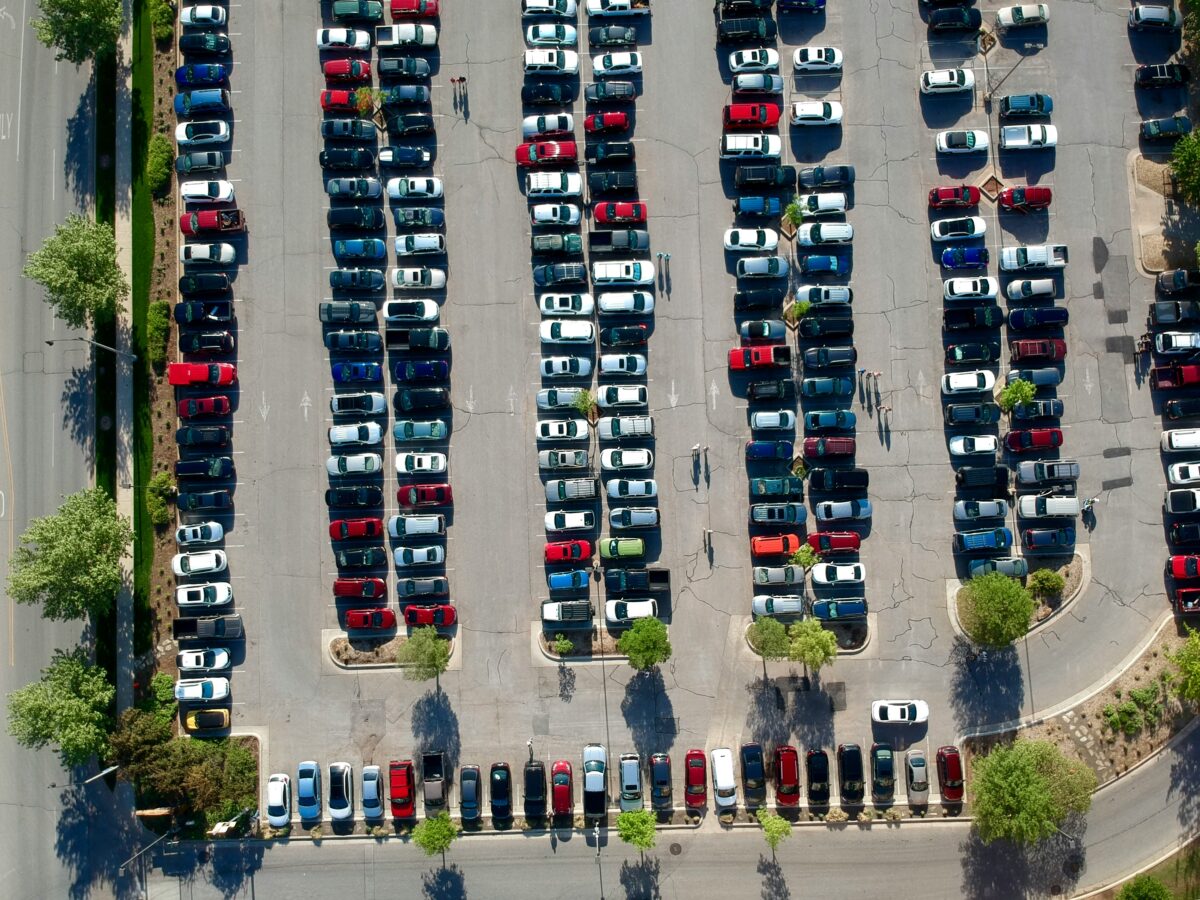

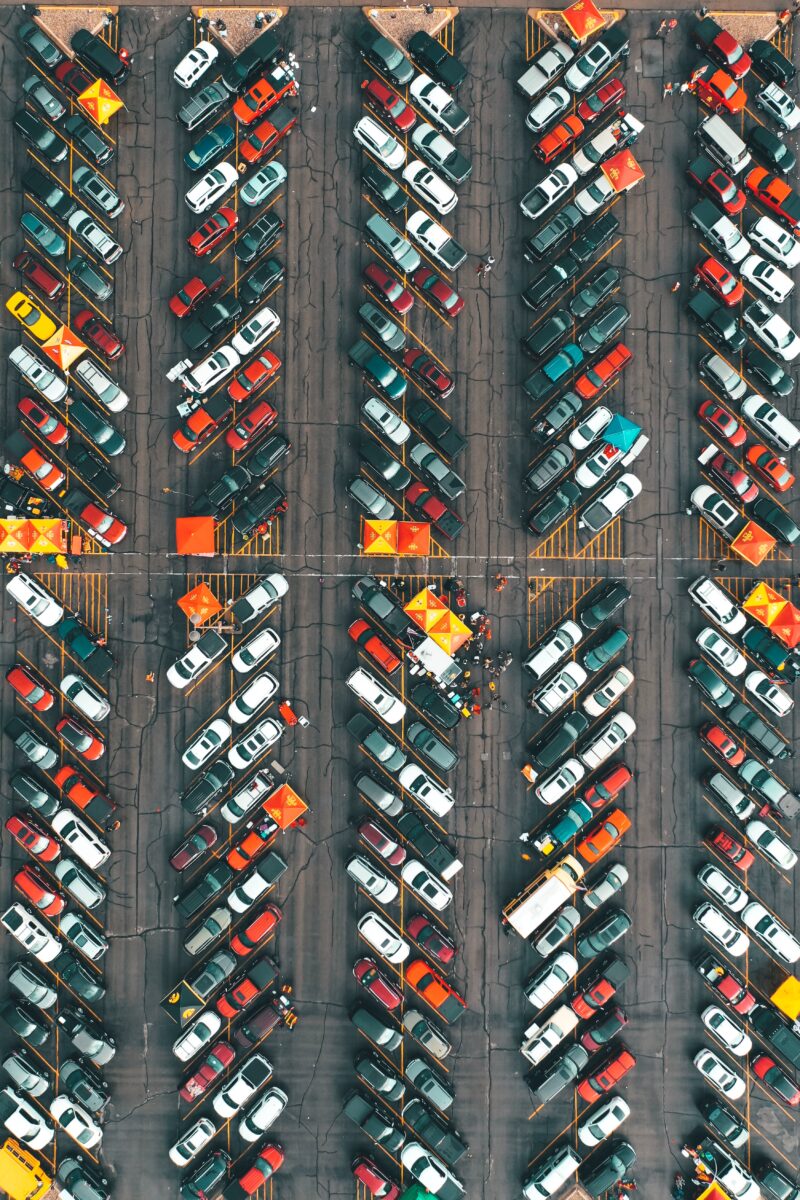

We know that ‘parking technologies’ are not just about managing car spaces and enforcement — it’s about how our communities work, live and thrive.

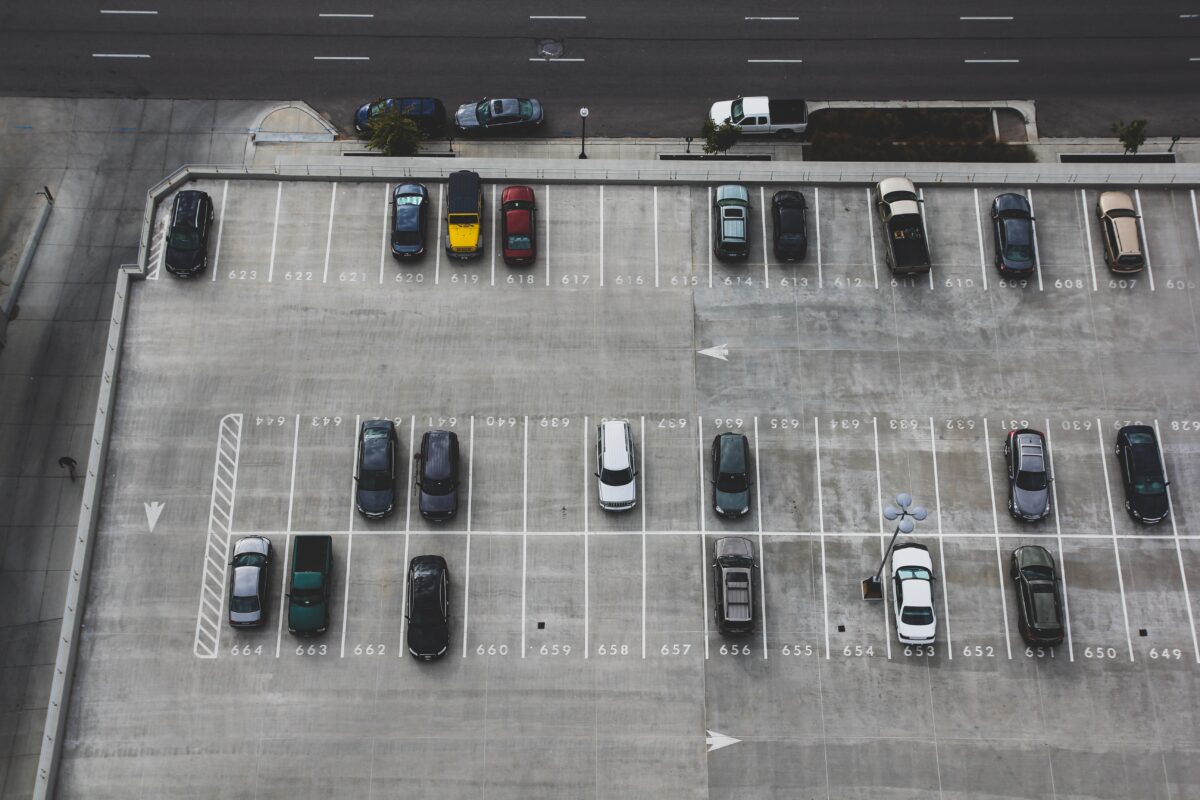

Unique to government

Orikan offers end-to-end solutions to make managing your commercial car park painless and straightforward. We can help you control access, whether that’s a card-in-card-out solution or barrier-free control, and manage payment and enforcement.